NewSpace Capital is a leading space-focused Private Equity firm. We invest in growth stage deep-tech companies that solve global challenges of sustainable economic and social development. As space sector reaches new heights, we focus on the technologies that enable it and applications that make it useful to the customers on Earth.

THE DISRUPTION OF ALL DISRUPTIONS

Why Space?

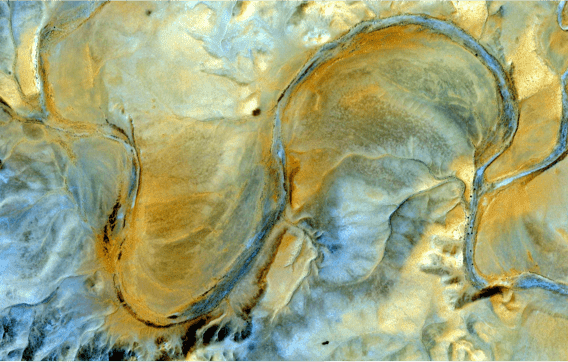

Space has become an integral part of our everyday life and is now a critical factor in the growth of the global economy. The orbits around our planet provide essential satellite infrastructure for our communication, networking, imaging, weather monitoring and navigation, – space holds the keys to further digital transformation and tackling one of the world’s most pressing problems, climate change.

€400B+

SPACE MARKET

IN 2022

€1,0T+

SPACE MARKET

IN 2040

€10T+

ECONOMIC ACTIVITY ENABLED BY SPACE

€140B+

INVESTED

SINCE 2010

PICKS & SHOVELS STRATEGY

Our Approach

At the time of the Space Rush, we invest in “picks & shovels” – the supply chain and downstream segments of the market. We lower risk by investing in leading companies with existent revenues and unique market position, and supporting management teams that demonstrate vision, clear strategies and track record of focused execution.

ACCESS TO UNIQUE DEALS

What We Invest In

In a fast-developing field, our extensive global network gives access to exclusive deals in underinvested and undervalued market segments. The unique industry experience and in-depth research allow our team to determine the opportunities with greatest potential for growth and risk-adjusted returns.

DOING WELL BY DOING GOOD

Tangible ESG Impact

Space technology and better analysis tools for large amounts of data are crucial in helping nations and companies address many of the UN Sustainable Development Goals, particularly monitoring greenhouse gas emissions, deforestation and biodiversity. The climate change is a $26 trillion growth opportunity.

The 60-year-old space industry has been transformed in the last decade by improved access to space, emergence of satellite platforms for Lower Earth Orbit, miniaturization of electronics, changing regulatory environment and growing demand for commercial and consumer applications. The global space industry now spans across multiple markets on Earth and beyond, becoming a key positive element in the technological and economic transformation of our society.