Both, the in-space and ground segments of the space ecosystem rely on a supply chain of specialised companies at different stages of the developmentand manufacturing process, from materials and components to systems and sub-systems. These companies also supply non-space industries and serve as cross-pollination factor in the continuous technical revolution. Diversified revenues of the supply-chain companies lower risk of investors in this segment.

Market segments

NewSpace Capital’s strategy is based on the in-depth understanding of the space industry informed by 150+ years of experience and on-going analysis of the market.

SIZE / POTENTIAL: €10+ BILLION / VERY HIGH

INVESTMENT HORIZON: 3 – 5 YEARS

Build

SIZE / POTENTIAL: €4+ BILLION / MEDIUM

INVESTMENT HORIZON: 5 – 7 YEARS

Launch

Access to space is a critical component of the space ecosystem. Falling launch prices were a key catalyst to the development of the commercial space market. As further technical innovation in this segment continues, we expect consistent growth in the space and space-related industries.

SIZE / POTENTIAL: €120+ BILLION / HIGH

INVESTMENT HORIZON: 5 – 7 YEARS

Broadcasting & Telecommunication

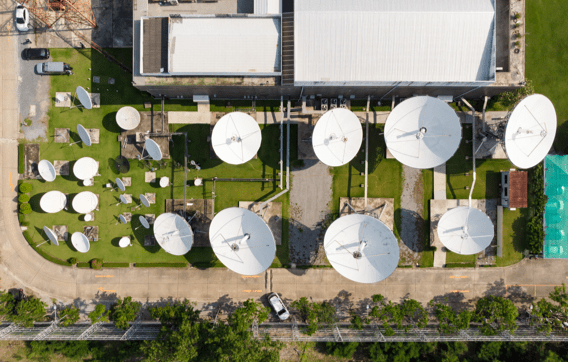

Satellite communication has become wide spread and ubiquitous throughout the world for such diverse applications like Television, DTH Broadcasting, DSNG and VSAT to exploit the unique capabilities in terms of coverage and outreach. The miniaturization of the satellites, commercial development of the Lower Earth Orbit (LEO) for IoT and Broadband open new chapter in the satellite communication.

SIZE / POTENTIAL: €10+ BILLION / VERY HIGH

INVESTMENT HORIZON: 3 - 5 YEARS

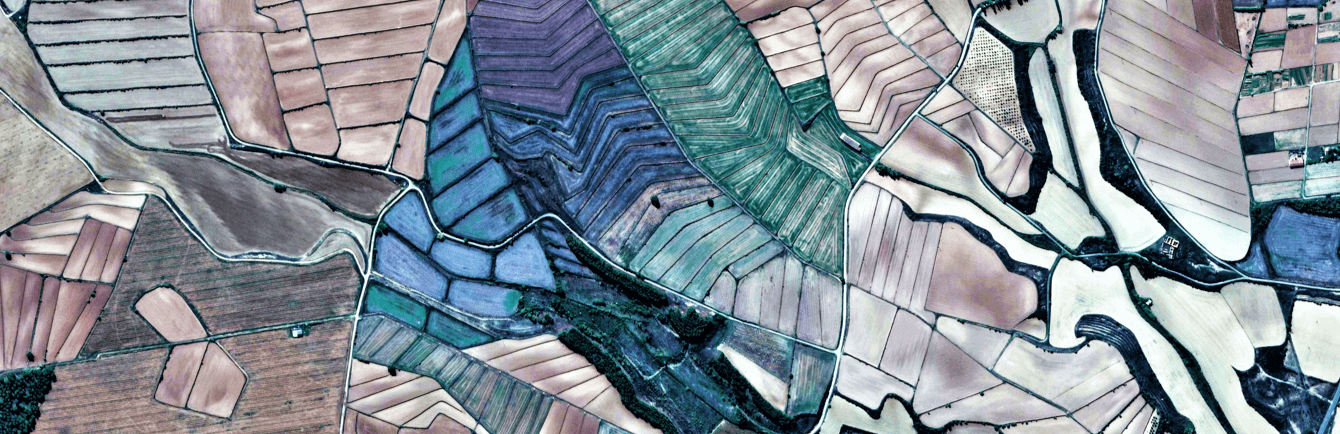

Earth Observation

Miniaturisation and digitalisation has seen the emergence of more cost efficient platforms, allowing the creation of a dynamiccommercial market forthe Earth Observation (EO) data and associated services. New technologies, like Synthetic Aperture Radar (SAR), allow consistent monitoring of Earth’s surface even at night and through the clouds. The fastest growing segment of the space ecosystem, EO is critical to monitor and battle climate change, as well as improve efficiency of our agriculture, transportation, construction, mining and energy.

SIZE / POTENTIAL: €80+ BILLION / VERY HIGH

INVESTMENT HORIZON: 3 – 5 YEARS

Navigation

Today, satellite navigation is omnipresent in the global transport sector, fromthe digitalisation of ports and railways to the guidance of innovative autonomous vehicles, as well as commercial jetliners and private airplanes, and even for the positioning of LEO satellites or the International Space Station. As autonomous transportation becomes widespread the demand for the next generation of high precision navigation will exponentially grow.

The 60-year-old space industry has been transformed in the last decade by improved access to space, emergence of satellite platforms for Lower Earth Orbit, miniaturization of electronics, changing regulatory environment and growing demand for commercial and consumer applications. The global space industry now spans across multiple markets on Earth and beyond, becoming a key positive element in the technological and economic transformation of our society.